Shermin Voshmgir: December 26, 2020

This text has been adapted from a chapter of the book Token Economy

Stability of value is one of the most important functions of money so it can fulfil its purpose as a unit of account. Stable tokens are designed to represent a store of value, medium of exchange, and unit of account that has a stable value against another currency or commodity, and could resolve a major bottleneck to mass adoption of tokens as a medium of exchange.

Short-term stability of value is one of the most important functions of money so it can serve as a unit of account. Stability is a fundamental criteria for meaningful economic planning for all actors in an economy. In order for a token to serve as a means of payment, store of value, or unit of account, the token needs a relatively stable value, so that the price we pay for goods and services can be reliably planned. Otherwise, it is just an object of speculation. While the Bitcoin protocol introduced a groundbreaking consensus algorithm, it comes with a minimal monetary policy that simply regulates and limits the amount of tokens minted over time. The protocol does not provide a economic algorithm that regulates price stability. As a result, Bitcoin and similar protocol tokens are subject to price volatility, which makes them an object of speculation rather than a means of day-to-day payment. From a monetary policy point of view, Bitcoin does not live up to its own value proposition stated in the white paper, as it cannot serve as electronic cash, which is why it is referred to by many as “electronic gold.”

Just as developing a secure consensus algorithm required decades of research and development, an equivalent amount of academic rigor would be needed to develop a resilient “monetary policy” in P2P electronic cash protocols. Token price also needs to be stable and resilient, hence attack resistant. However, there is no need to reinvent the wheel. Governments have been using macroeconomic models to stabilize national currencies with measures like currency intervention. There is much one can learn from this, both the dos and the don’ts. However, history has shown that protecting currency stability from outside attacks is not easy to achieve. In 1992, for example, George Soros hacked the stability mechanism of the Bank of England, successfully manipulating the foreign exchange price of the British pound, in an event that is now referred to as “Black Wednesday” and ended up costing the UK more than three billion pounds at the time.

State-of-the-art protocol tokens (many refer to them as cryptocurrencies) are currently impractical for day-to-day payments, at least in countries with stable inflation rates, and only attractive to speculators or long-time investors. Token values are volatile for several reasons: (i) a static monetary policy as a result of a token supply that does not adjust to price levels, (ii) shifting public perception about the value of the token, (iii) the fact that they represent assets in an emerging market that most people don’t understand, and potentially also (iv) market reaction to regulatory uncertainty. Without a stable medium of exchange, no party to a smart contract can rely on the price denominated of a certain token. This lack of price stability has led to the emergence of stable tokens over the last few years.

Stable tokens are emerging as an indispensable building block for a tokenized economy. Businesses and individuals are not likely to accept tokens as a method of payment if their value can drop within a short amount of time. Salaries, investments, and daily expenses such as rent, utility payments, and groceries cannot be reliably denominated or planned for with an unstable medium of exchange. Without stability mechanisms, smart contracts and decentralized applications will stay a fringe phenomena, as they would pose a high risk for both parties to a smart contract, the buyer and the seller. Over the years, various attempts have been made to achieve token stability:

Fiat-collateralized or commodity-collateralized stable tokensCrypto-collateralized stable tokensAlgorithmic stable tokens, like seigniorage shares.Central banks have started looking into tokenizing their currencies, as these already come with inbuilt price stability mechanisms.

Read more on (i) Fiat-collateralized or commodity-collateralized stable tokens, (ii) Crypto-collateralized stable tokens and (iii) Algorithmic stable tokens in my book Token Economy. In the following I will focus on Central Bank Digital Currencies.

CBDCs

While the crypto community has been experimenting with various privately initiated stable token solutions, central banks have also started to look into tokenizing their own currencies and settling token transactions on some kind of distributed ledger solution. Tokenized fiat money already comes with an inbuilt stability mechanism. Such a central bank token, referred to as Central Bank Digital Currency (CBDC), acts as a tokenized representation of a country’s fiat currency. The stability mechanisms are provided by established players like central banks in collaboration with the fiscal and monetary policy of a national government. CBDCs would be part of the base money supply, together with other forms of money: cash and other cash equivalents (M0 & M1), short-term deposits (M2), and long-term deposits (M3). CBDCs could be used for the settlement of smart contracts, since their tokenized equivalent can be managed by an underlying distributed ledger.

Some economists believe that CBDCs compete with commercial bank deposits and reduce the cost of managing the local and international payment system. Currently, the cost of managing cash supply of a country is high, as are cross-border transactions. In the long run, CBDCs could eliminate the need for classic bank accounts, replacing them with easy to download mobile crypto wallets, and potentially increase inclusion of the underbanked. However, such disintermediation of commercial banks and of cross-border payments could also destabilize the credit systems and foreign exchange markets, at least in the short term. CBDCs could furthermore challenge the practice of fractional reserve banking and eliminate the need for deposit guarantees. Issuing central bank money directly to the public could also provide a new channel for monetary policy execution. This would allow for direct control of the money supply and could complement or substitute indirect tools such as interest rates or quantitative easing. Some economists even think that CBDC could be a method to achieve a full reserve banking system.

However, until the announcement of a Facebook led consortium — Libra consortium — to launch a stable token for internet payments, most central banks were sceptical about tokenising their national currencies. The Libra initiative might have been the black swan event that triggered many central banks to rethink their stance. According to a study conducted by the Bank of International Settlement, many governments are thinking of tokenizing their currency or have already started to do so to various degrees (around 80 percent), such as the Bank of England, Central Bank of Sweden, Central Bank of Uruguay, Marshall Islands, China, Iran, Switzerland, and the European Central Bank. It is, therefore, quite likely that within the next three to five years, many central bank-issued currencies will have a tokenized equivalent. “Synthetic CBDCs” (sCBDC) is an alternative concept whereby private institutions issue tokens fully backed with central bank reserves. The question is whether CBDCs and sCBDCs might render private stable token efforts obsolete, or if they will become just some of many other tokens in this new tokenized economy ahead of us.

Bank for international Settlement on CBDCsEuropean Central Bank on CBDCsIMF on CBDCs

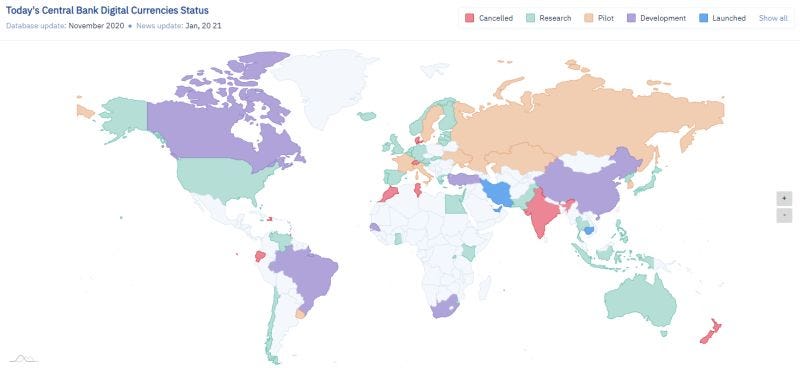

LEARNING TOOL – CBDCS TRACKER

The CBDC tracker is playful graphical tool to educate about current CBDC projects and compare CBDC projects with each other. It features:

- Dynamic visualization of all CBDC projects worldwide that can be filtered by the dimension retail/wholesale CBDC

- Searching tool for concrete CBDC projects and juristictions

- Timeline to track the evolution of a certain CBDC

- Whatchlist to add most relevant CBDC projects in order not to miss any update on a specific CBDCNewsfeed integration to know what’s going on in the news/media.

This text has been adapted from a chapter of the book Token Economy

About “Token Economy”While it has become easy to create a token, which is collectively managed by a public infrastructure like a blockchain, the understanding of how to apply these tokens is still vague. Tokens can represent anything from an asset to an access right, like gold, diamonds, a fraction of a Picasso painting or an entry ticket to a concert. Tokens could also be used to reward social media contributions, incentivize the reduction of CO2 emissions, or even ones attention for watching an ad. The book refers to tokens, instead of cryptocurrencies, and explains why the term “token” is the more accurate term, as many of the tokens have never been designed with the purpose to represent a currency. This book gives an overview of the mechanisms and state of blockchain, the socio-economic implications of tokens, and deep dives into selected tokens use cases: Basic Attention Token, Steemit, Token Curated Registries (TCRs), purpose-driven tokens, stable tokens, asset tokens, fractional ownership tokens, Libra & Calibra (Facebook), and many more. The second edition of the book Token Economy (June 2020) which was originally published in June 2019 comes with updated content of existing chapters and four additional chapters: “User-Centric Identities,” “Privacy Tokens,” “Lending Tokens,” and How to Design a Token System and more focus on the Web3.